In the real estate market, the cap rate is a critical tool. Property managers and investors use the capitalization rate to assess the profitability and risk of a property. A rent roll provides detailed information about a property's rental income and tenant information. At the same time, the capitalization rate helps investors evaluate the return on investment for a property.

Understanding how these two tools work together can help investors a lot in Alabama and other states. They get to make informed decisions about whether to invest in or manage a property effectively.

What is a Cap Rate in Real Estate?

Cap rate in real estate is short for capitalization rate. A cap rate is a key metric used by real estate investors to determine the return on investment (ROI) of a rental property. The calculation normally doesn't consider the mortgage because they just want to see how the property performs independent of financing. You can think of a cap rate like a speedometer that calculates how fast a property pays you back in income for operations only.

What is the Capitalization Rate Used For?

Capitalization rate in real estate is very important in determining whether you should invest in a property or not. The capitalization rate helps investors determine the potential return on investment (ROI) of a property. It can help assess whether a property is worth purchasing, holding, or selling. These are the three major uses of the capitalization rate:

- To Compare Two Similar Properties: Capitalization gives the investor a snapshot of the property's profitability and risk. With this, they can make an informed decision.

- To Value a Property: Capitalization helps in valuing a property for both the seller and buyer. When an investor understands the capitalization rate, they can price it correctly.

- Risk Assessment: Most investors want to be able to correctly analyse the risk they are taking, and that is why the capitalization rate is important. A high capitalization rate means higher risk and lower price, while a low capitalization rate implies lower risk and higher price.

Ways to attract tenants for commercial property

How is Cap Rate Calculated

Cap rate is calculated by dividing the net operating income (NOI) by the property’s current market value. You can also use the purchase price as the market value. The capitalization rate can help assess whether a property is worth purchasing, holding, or selling. For example, a property that generates $100,000 in net operating income and has a market value of $1 million. The cap rate for the property would be 10%.

For a clearer understanding of how the cap rate is calculated, let us break down these key components further. The net operating income (NOI) is a property's income after operating expenses are deducted before taxes and interest. The market value represents the property's current worth, which may fluctuate based on market conditions.

- Net Operating Income (NOI): This is the profit made from the rental property in a year minus the operating costs.

- Property Current Value: This can be how much you bought the property or the selling price.

Read; Everything on how to create and manage a rent roll.

Cap Rate Formula

The cap rate formula is a straightforward process and very easy to use:

Cap Rate = Net Operating Income (NOI) / Property Value

Breaking down the cap rate formula a little more:

Cap Rate = (Annual Rental Income - Annual Operating Expenses) / Property Value

This approach allows investors in Florence to calculate the potential return on a real estate investment. For example, if a property generates $80,000 in NOI and has a market value of $1 million, the cap rate would be 8%. This calculation is essential for investors to determine the rate of return they can expect. They can also compare it to other investment opportunities.

Interpretation of the Cap Rate Formula:

A higher Cap Rate indicates:

- Higher return on investment

- Lower property value relative to income

- Potential for increased cash flow

A lower Cap Rate indicates:

- Lower return on investment

- Higher property value relative to income

- Potential for decreased cash flow

Typical Cap Rate Ranges:

- Multifamily: 4-8%

- Office Buildings: 5-10%

- Retail: 5-12%

- Industrial: 6-14%

- Apartments: 4-8%

It is important to ensure that the NOI is accurate when using the cap rate formula, as it directly affects the cap rate outcome. When calculating the NOI, investors must account for all operating expenses, such as maintenance, property management fees, and insurance.

How to find the right tenants for your property

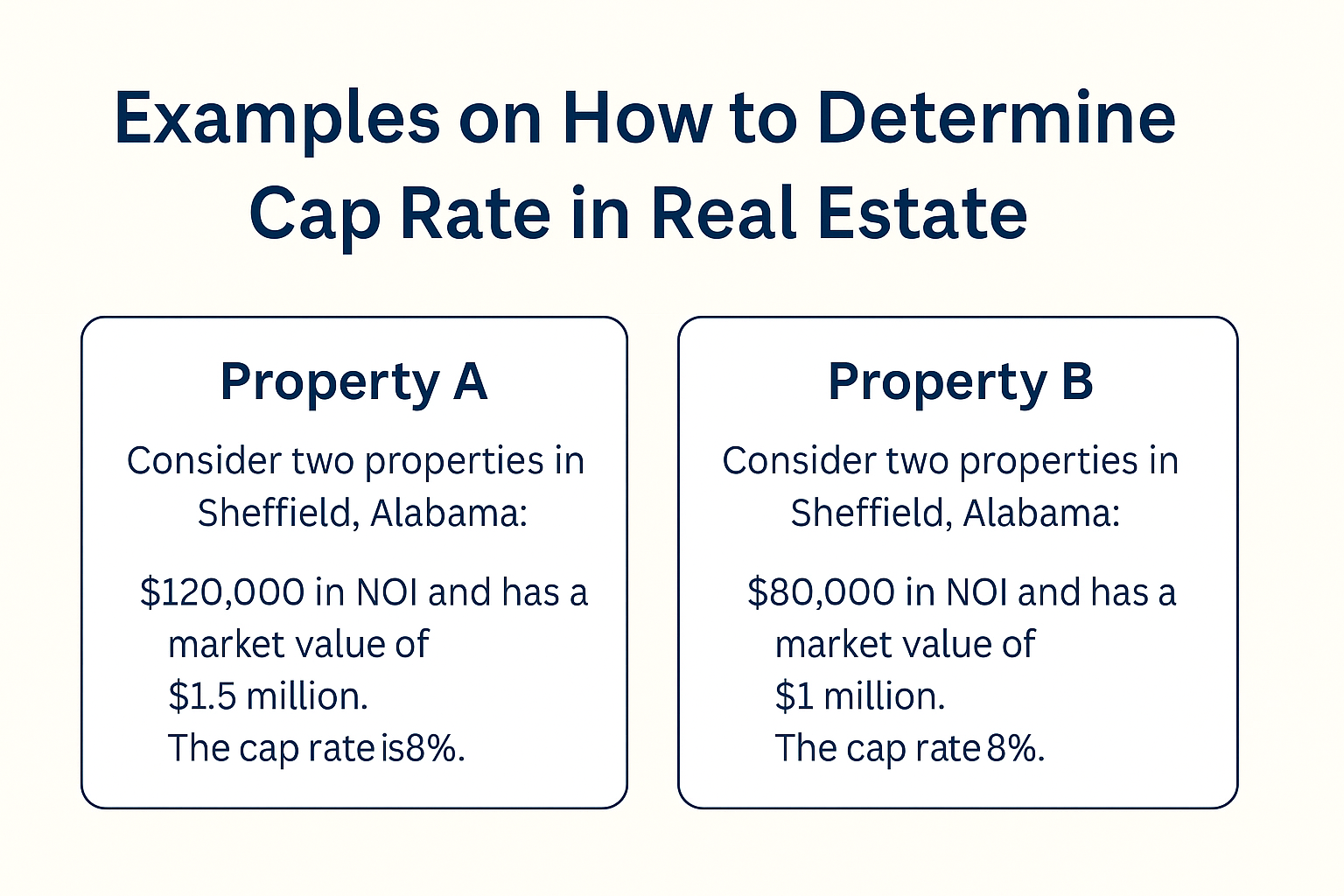

An Example of How to Determine Cap Rate in Real Estate

Consider two properties in Sheffield, Alabama:

- Property A generates $120,000 in NOI and has a market value of $1.5 million. The cap rate is 8%.

- Property B generates $80,000 in NOI and has a market value of $1 million. The cap rate is 8%.

Both properties have the same cap rate, but Property A generates more income. This example emphasizes how the cap rate helps investors compare properties based on their potential return.

Read Getting insurance for an apartment building

What Is a Good Cap Rate for Rental Property?

A good cap rate for a rental property depends on various factors like the property location and the risk level the investor is willing to accept. Other factors include the specific goals of the investment. Cap rates for rental properties typically range between 5% and 10%, depending on the type of property and its location.

A cap rate of 7%-10% for rental property is considered good for riskier or less desirable properties. It also suggests a higher potential return on investment. A lower rate of 4%-7% may suit prime properties with stable rental income and lower risk. A good cap rate varies based on the rental property specifics and the investor's objectives.

Good Cap Rate for Rental Property in Alabama

- 5–6%: Typical in more stable, lower-risk markets (urban, high-demand areas)

- 7–10%: Found in smaller towns or slightly riskier markets (like some parts of North Alabama)

- Over 10%: Often comes with higher risk or value-add opportunities.

In North Alabama, a cap rate of 7–9% is often considered strong and attractive for single-family and small multifamily rentals.

Key to effective apartment management

Risk Associated with High or Low Capitalization Rate

High and low cap rates have the following risks.

A high cap rate:

The property is located in a less desirable area. They state that the property may have a higher vacancy risk or require significant repairs. Investors should carefully assess whether the higher return justifies the potential risks of a high-cap rate property.

Low cap rate:

Investors may need to weigh whether the stability of the property is worth the lower potential return. Low Cap Rate properties are often seen as safer investments. However, they may not provide the same profit level as higher cap rate properties.

It suggests the property is in a desirable location with a stable income. However, the return on investment may be lower.

Read all you need to know about Florence, Alabama

Limitation of Cap Rate

While the capitalization rate is a value tool for real estate investors, it also has limitations. The cap rate does not account for future changes in income or expenses. This is one of the most significant limitations.

For example, unexpected repairs or vacancies could lower a property’s NOI. This will further reduce the cap rate and make the property less profitable than originally calculated.

Cap rate assumes stable market conditions, which may not always be true. In Florence, for example, property values and rental demand can fluctuate. The cap rate may not completely represent the property's potential risk or reward.

Additionally, the cap rate does not consider financing costs, such as mortgage interest. This can significantly impact the overall profitability of a real estate investment. Cap rate is a quick snapshot, but it leaves out a lot:

| Cap Rate Ignores | Why It Matters |

|---|---|

| Financing terms | Loan interest and payments affect ROI |

| Appreciation potential | Some properties gain value faster |

| Market trends | Area may be declining or booming |

| Future repairs/expenses | Big repairs could shrink your income |

| Vacancy and turnover | These kill NOI and skew the cap rate |

Read; Everything About Inventory Home and Customise Home.

What Affects the Cap Rate?

Various factors can affect the cap rate of a property. They include market conditions, location, and the type of property being evaluated. Real estate market trends can have a significant impact on cap rates. Some of these are changes in supply and demand for rental properties.

Location is one of the most important factors in determining cap rates. Properties in highly desirable areas with low vacancy rates tend to have lower cap rates. They are considered less risky.

Conversely, properties in less desirable locations may have higher cap rates. They reflect the higher level of risk involved in owning and managing the property.

Read; What The Best Property Managers Do To Maximize Returns for Investors

Conclusion

Understanding the cap rate empowers you to make smarter investment decisions. By evaluating factors like location, market trends, and income. This enables potential investors to determine whether a property aligns with their financial goals.

While the cap rate has its limitations, it remains one of the most reliable tools for evaluating risk and projecting returns. When used correctly, it helps investors protect their capital and maximize long-term profitability.

At Stutts Property Management, we support property owners and investors with data-driven insights. This strengthens decision-making and improves rental performance. If you’re looking to analyze a property or get expert guidance on your rental portfolio, our team is here to help.

→ Contact Stutts Property Management for Expert Investment Support

Also read on:

types of apartment building insurance coverage

Tips and tricks for a smooth rent application

Frequently Asked Questions (FAQs) on Cap Rate.

1. Rate cap calculator

A rate cap calculator helps determine the maximum rate a loan or investment can reach over time. It’s commonly used for loans with variable interest rates. By inputting key variables, such as the loan amount, interest rate, and loan term, the calculator provides an estimate of the highest possible rate. Using a rate cap calculator ensures borrowers understand potential future costs, helping them avoid financial surprises if interest rates increase significantly. Read on things to do in Florence

2. Interest rate cap

An interest rate cap is a limit set on how high an interest rate can rise on a variable-rate loan. For example, if you have a mortgage with a 5% cap, your interest rate cannot exceed 5%, no matter how high market rates go. This cap protects against large rate hikes. It's useful for borrowers looking for predictability in payments, especially when interest rates are expected to fluctuate over the life of the loan.

3. What is a good cap rate for rental property?

A good cap rate for rental property typically falls between 5% and 10%, depending on location and market conditions. A higher cap rate suggests better returns but often comes with higher risk. For stable and low-risk areas, a lower cap rate is expected. Conversely, in emerging or risky markets, a higher cap rate is common. It’s essential to compare cap rates in the area to evaluate whether an investment aligns with your financial goals. Read on 8 budget-friendly bedroom ideas

Read on benefits of using property management software

4. Cap rate calculator real estate

A cap rate calculator in real estate is used to determine the profitability of an investment property. It’s calculated by dividing the property’s annual net operating income (NOI) by the property’s current market value or purchase price. This calculation helps investors assess potential returns. A higher cap rate suggests better returns, but it may also indicate a higher risk. It's a valuable tool for comparing properties and understanding investment viability.

Read on how marketing can maximize your rental income

5. What is cap rate in commercial real estate?

Cap rate in commercial real estate is a metric used to measure the return on investment for a property. It’s calculated by dividing the property’s net operating income (NOI) by its market value. The cap rate helps investors assess the risk and potential return of a property. A high cap rate suggests a higher return but also higher risk, while a low cap rate indicates a lower return but often less risk in stable markets.

6. What is cap rate on commercial property?

The cap rate on commercial property is a percentage used to evaluate the potential return on investment (ROI). It is calculated by dividing the property’s annual net operating income (NOI) by its current market value or purchase price. A higher cap rate generally indicates a higher return and higher risk, while a lower cap rate suggests a more stable investment with lower potential returns. It helps investors assess the risk and profitability of commercial real estate.

Read on for effective rental property accounting tips

7. How to calculate the cap rate on a rental property?

To calculate the cap rate on a rental property, divide the property’s annual net operating income (NOI) by the property’s purchase price or market value. The formula is:

Cap Rate = (NOI ÷ Property Price) × 100

The NOI is the annual income the property generates after operating expenses, such as maintenance, taxes, and insurance. A higher cap rate suggests a higher return on investment, while a lower cap rate typically indicates lower risk and stable returns.

Read on things to consider when choosing a leasing-only service

8. What is a good cap rate for commercial real estate?

A good cap rate for commercial real estate typically ranges from 6% to 12%, depending on the location and risk level. Higher cap rates usually indicate higher-risk properties or emerging markets, but they also offer higher potential returns. Lower cap rates typically signify stable, well-established markets with lower risk. Investors should balance the cap rate with other factors, such as the property’s condition and the local market’s growth potential, to determine if the investment aligns with their goals.

9. Cap rate compression

Cap rate compression occurs when the cap rates for real estate investments decrease over time. This usually happens when property values increase, causing the rate of return to decline relative to the price. In markets with high demand or low interest rates, cap rate compression can be common, indicating that properties are being purchased at higher prices. While this can lower potential returns, it often signals confidence in the market and economic growth in the area.

Read 100 bedroom wall decor ideas

10. How to determine cap rate on rental property?

To determine the cap rate on rental property, divide the property’s annual net operating income (NOI) by its market value or purchase price. The formula is:

Cap Rate = (NOI ÷ Property Price) × 100

The NOI is the total income from rent after deducting all operating expenses, such as repairs and property taxes. A higher cap rate indicates a better return on investment, while a lower rate suggests a lower but more stable return. This method helps investors compare different properties.

Read why you should consider investing in Florence, Alabama

11. Cap rate vs cash on cash

Cap rate and cash-on-cash return are both important metrics for real estate investors, but they measure different things. The cap rate measures the overall return on a property based on its net operating income (NOI) and market value. Cash-on-cash return focuses on the return generated based on the amount of cash invested, excluding debt. While the cap rate gives an overall view of property profitability, cash-on-cash return is more relevant for evaluating investment efficiency.

Read on property management vs self-management

12. Exit cap rate

The exit cap rate is the projected cap rate used when estimating the sale price of a property. It’s used by investors to predict the potential return when selling the property in the future. The exit cap rate typically reflects market conditions at the time of sale, and it helps investors forecast their future profits. A lower exit cap rate generally indicates a higher sale price, while a higher cap rate suggests a lower sale price.

13. Terminal cap rate

The terminal cap rate is the projected cap rate used to calculate the future sale price of a property at the end of the investment holding period. It reflects the expected market conditions and future income generation potential of the property. Investors use the terminal cap rate to estimate their exit price and determine their overall return on investment. A lower terminal cap rate typically indicates a higher future sale price and lower expected risk.

Is outsourcing your tenant screening process a good idea

14. Apartment cap rates

Apartment cap rates are used to assess the profitability of apartment buildings as real estate investments. Like other property types, apartment cap rates are calculated by dividing the property’s net operating income (NOI) by the market value. Cap rates for apartments can vary based on location, property condition, and the local rental market. Investors typically look for higher cap rates in emerging or riskier markets and lower cap rates in established, stable markets.

Essential property maintenance tasks to know

15. How is the cap rate used in real estate investments?

Investors use cap rates to evaluate potential returns on real estate investments. A higher cap rate suggests higher risk but potentially higher profits. Comparing cap rates helps investors decide where to invest their money.

16. What factors affect the cap rate in real estate?

Key factors affecting cap rates include property location, market conditions, tenant stability, and interest rates. High-risk markets generally have higher cap rates, while stable areas have lower ones. Understanding these factors helps investors make better decisions.

17. What is the relationship between cap rates and property value?

Cap rates and property values have an inverse relationship. Higher cap rates generally indicate lower property values, while lower cap rates suggest higher values. Investors analyze this relationship to assess property profitability.

How to become a successful real estate investor

18. How do market conditions affect cap rates?

In strong markets, cap rates tend to be lower due to high property demand. Economic downturns often increase cap rates as property values decrease. Monitoring market trends helps investors determine the best opportunities.

19. Can cap rates be negative?

Yes, a negative cap rate occurs when a property’s operating expenses exceed its income. This typically happens in distressed properties or poorly managed investments. Investors should avoid negative cap rates unless they plan to improve profitability.

Essential guide to rental analysis

Cap rates are a powerful tool for evaluating rental properties, but interpreting them correctly is key. Stutts Property Management can help you analyze your investments and maximize returns.